What are equity waterfalls?

An equity waterfall is the breakdown in a private equity real estate transaction that outlines how the distributions will be handled between the operator and, you, as the passive investor.

In private equity real estate transactions there are typically 3 different waterfalls to consider:

Cash Flow Waterfall: how the cash flows of the asset will be distributed during the hold period.

Refinance Waterfall: how the proceeds from a cash out refinance will be distributed

Sale Promote Waterfall: how the sale proceeds are distributed once the asset is sold

What are equity hurdles?

Inside the waterfalls outlined above, there are different points at which equity splits will occur in a waterfall and these are called “hurdles.” Not only do these hurdles allow for equity splits to change but these are also used to outline when investor capital is returned as you will see in the refinance and sale promote waterfalls.

Cash Flow Waterfall

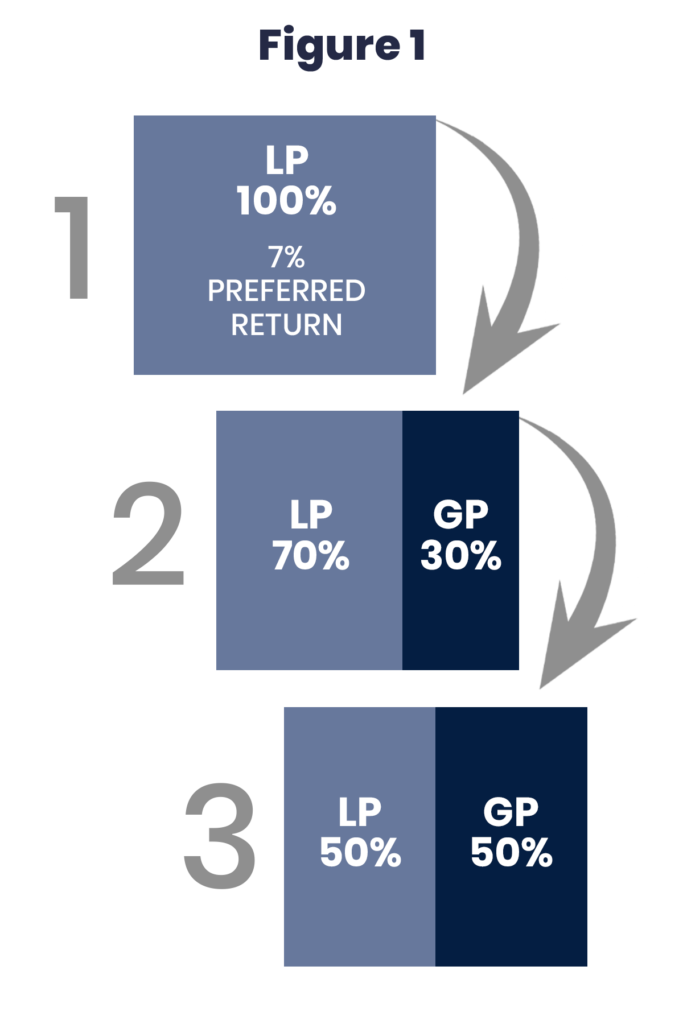

The cash flow waterfall is going to outline how the cash being generated from the asset will be distributed during the hold period. Reference figure 1 as we describe the following hurdles that are commonly used in this type of waterfall.

Bucket #1: Preferred Return Hurdle

It is common to see 100% of the cash flows being distributed to passive investors up to a certain amount. This would be called the “preferred return” which you will remember was discussed in our previous newsletters in detail. Once this bucket is filled up, with all passive investors receiving their preferred return, then the cash flows will begin filling up the next bucket.

Bucket #2: Common Equity Hurdle

In this bucket, the cash flows will now be split 70% to the passive investors and 30% to the operator. In some scenarios you may have a preferred equity hurdle that would come into play prior to this common equity hurdle. For this illustration I have kept this simple, but next month I will dive deeper into a scenario with the preferred equity hurdle at play. Once this bucket is filled up the remaining cash will begin filling up the next bucket.

Bucket #3: Performance Hurdle

This is considered a performance-based hurdle with our group as we set this secondary hurdle based on the originally projected returns. For example, if we originally projected a 13% IRR then this hurdle would not come into play until the passive investors achieved a 13% IRR. At this point forward, since there are no other buckets to fill up, the remaining cash flows are split 50/50. However, it is rare for a cash flow waterfall to hit this secondary hurdle. This hurdle is not usually reached until there is a refinance or sale of the asset.

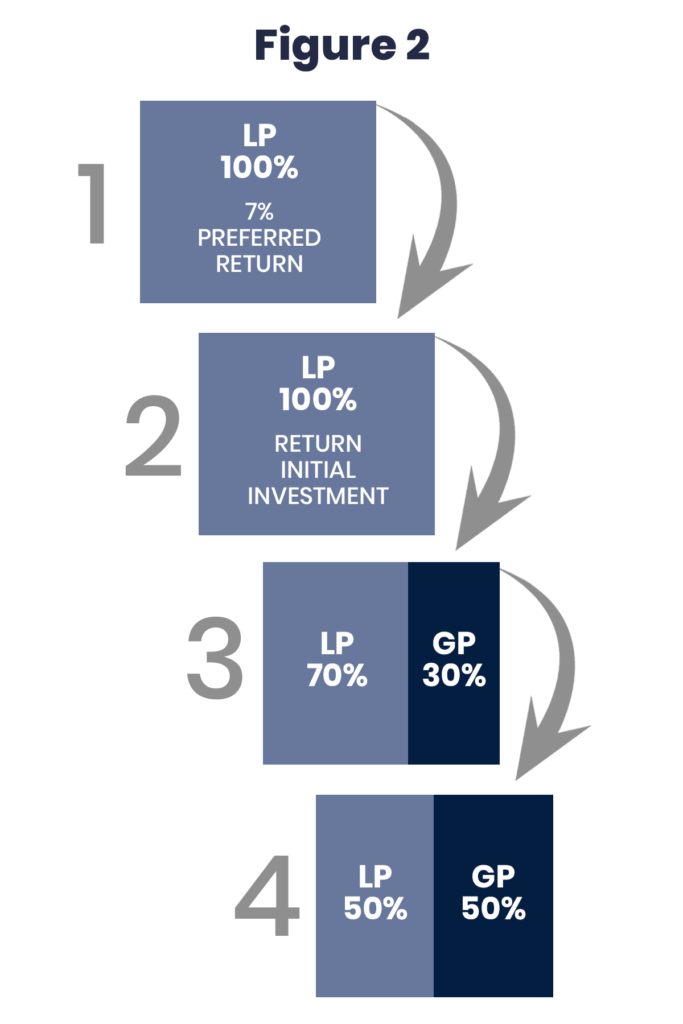

Refinance Waterfall

The refinance waterfall will outline how the proceeds from a cash out refinance will be distributed. This is an important waterfall to pay attention to when you decide to invest passively. As the passive investor, you will want to make sure that your initial capital has been returned in full prior to the operator receiving any of the refinance proceeds.

If you are in a preferred equity position with only a preferred return with no upside in a deal, you will want to make sure that in this hurdle you are not completely taken out by returning your preferred capital first. Otherwise you will be completely taken out of the deal since the preferred return is based on your unreturned capital contribution. Even though cash flows and sale proceeds will pay out to preferred equity investors first, you will want to make sure that in a cash out refinance that the unreturned capital contributions are repaid based on each investors equity percentage with no regard to class of shares.

Reference figure 2 as we describe the following hurdles that are commonly used in this type of waterfall.

Bucket #1: Preferred Return Hurdle

The first thing that should happen when distributing the cash from a refinance should be to catch up any lagging preferred returns to the passive investors. This would be important if there was a year or two where you did not receive your preferred return. NOTE: Be sure to understand the difference between a cumulative and non-cumulative preferred return. Once this bucket is filled up the return of capital will begin.

Bucket #2: Unreturned Capital Contribution Hurdle

In this bucket, the refinance proceeds will continue distributing back your pro-rata share of unreturned capital contribution until you are 100% paid back your initial capital invested. Once this bucket is full, the remaining cash will go to the next bucket.

Bucket #3: Common Equity Hurdle

In this bucket, the remaining cash from the refinance will be distributed 70% to you and 30% to the operator. Once this bucket fills up, the remaining cash goes to the next bucket.

Bucket #4: Performance Hurdle

In this bucket, once the performance IRR has been achieved, the remaining cash from a refinance would be split 50% to you and 50% to the operator. In a refinance scenario, this hurdle is rarely achieved. It is often very rare to see the refinance waterfall to surpass the return on initial capital to investors. However, the entire waterfall is still laid until just in case.

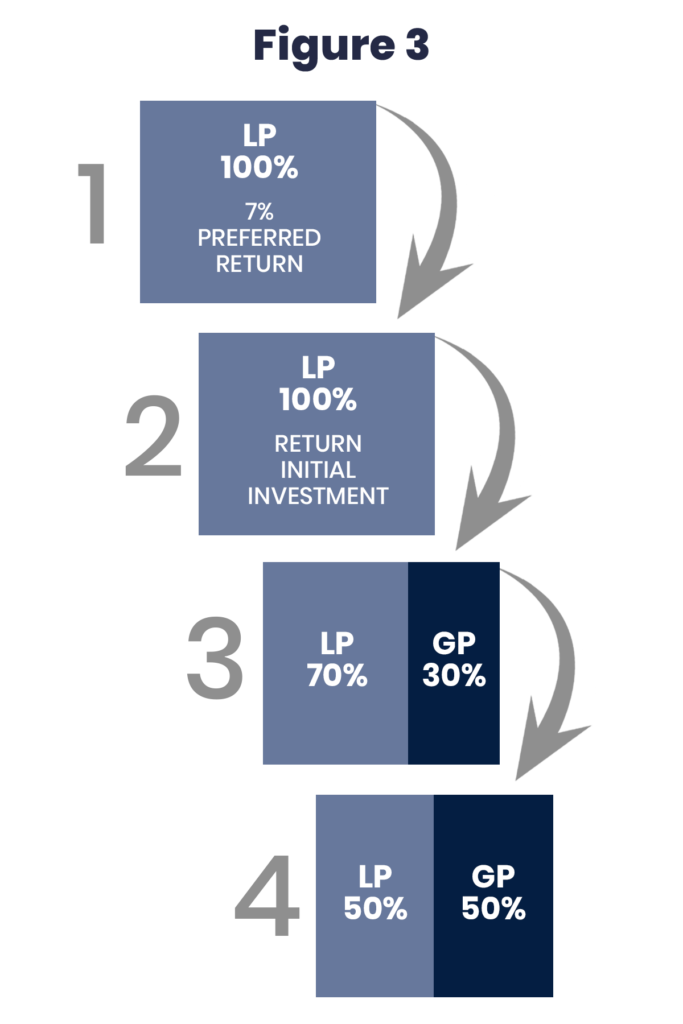

Sale Promote Waterfall

The sale promote waterfall will outline how the cash from a sale of the asset will be distributed. This is the most important waterfall to pay close attention to when evaluating your future investments. As you saw in the refinance waterfall, you will want to make sure that all of your unreturned initial capital has been returned prior to any equity splits with the operator.

Reference figure 3 as we describe the following hurdles that are commonly used in this type of waterfall.

Bucket #1: Preferred Return Hurdle

The first thing that should happen when distributing the cash from a sale, as you saw in a refinance, should be to catch up any lagging preferred returns to the passive investors. Once this bucket is filled up the return of capital will begin in the next bucket.

Bucket #2: Unreturned Capital Contribution Hurdle

In this bucket, the sale proceeds will continue distributing back your pro-rata share of unreturned capital contribution until you are 100% paid back your initial capital invested. Once this bucket is full, the remaining cash will begin filling up the next bucket.

Bucket #3: Common Equity Hurdle

In this bucket, the remaining cash from the sale proceeds will be distributed 70% to you and 30% to the operator. Once this bucket fills up, the remaining cash will go to the next bucket.

Bucket #4: Performance Hurdle

In this bucket, once the performance IRR has been achieved, the remaining cash from a sale would be split 50% to you and 50% to the operator.

Our group typically does not have any hurdles past this last bucket. However, many groups will offer several different equity splits in their waterfall structures which allows for larger and larger equity splits for their group as they continue to outperform the asset.

At this point, you may be thinking about how we keep track of these various hurdles throughout the life cycle of the investment. In the past, we used to use advanced spreadsheets to keep track of these various waterfalls. Now we are using our advanced web-based investor portal that was launched last month to keep track of these waterfalls. Inside our admin-side of the investor dashboard we load each hurdle in each of the waterfalls. It is nice as it takes the manual work out of the workflow and allows us to keep track of these much easier.