If you’ve already explored how promissory note funds can protect capital and deliver steady income, the next question is: Should you invest in a single note or a diversified fund?

Promissory notes let you step into the lender’s seat, earning asset-backed, contractual returns that don’t depend on equity upside. But how you invest, as a standalone note or through a fund, shapes your risk, liquidity, and return profile.

Let’s break down what you need to know so you can say yes to promissory notes with clarity and confidence.

What Are Your Options?

There are two main ways to invest in promissory notes:

Individual Promissory Note — You invest in a single real estate-backed loan, typically with a fixed term and yield.

Fund of Promissory Notes — You invest in a pooled structure managed by an operator that allocates across multiple notes.

Both can be smart tools, depending on your goals, timeline, and risk tolerance.

Why This Decision Matters

Promissory notes are gaining traction in today’s high-interest environment, especially among investors looking for consistent income and reduced volatility. But how you access that opportunity matters.

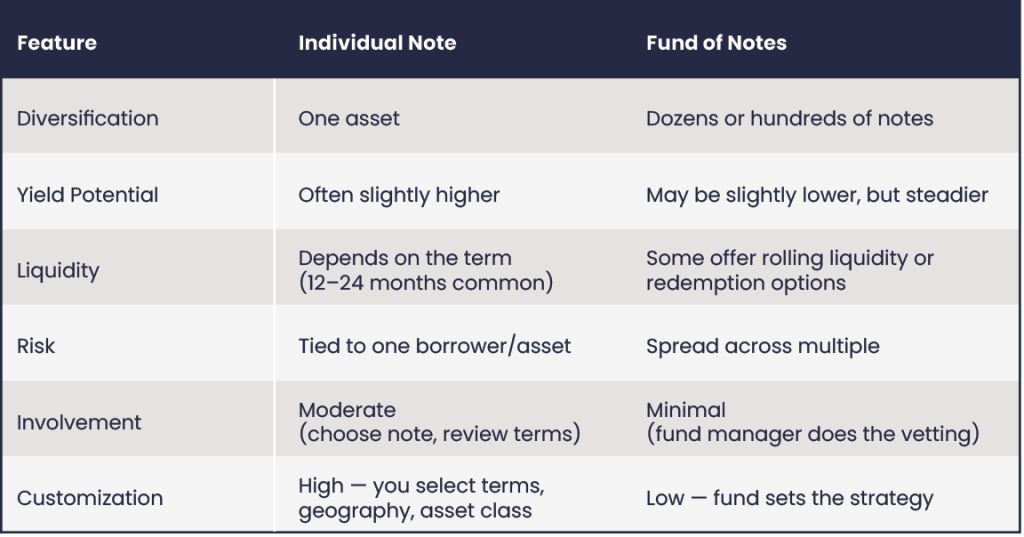

An individual note and a fund of notes deliver different results when it comes to yield, liquidity, diversification, time involvement and risk exposure.

Risk isn’t eliminated; it’s redistributed. An individual note offers more control, higher potential yield, and precise targeting, but it’s concentrated. A fund

reduces risk through diversification but gives up some control and yield in exchange for ease.

Without this framework, many investors default to indecision. Let’s remove that barrier.

When an Individual Note Makes Sense:

You want maximum control, targeting a specific outcome, and are comfortable evaluating the terms.

When a Fund Makes More Sense:

You want ease, broader diversification, and prefer someone else to handle selection, vetting, and ongoing management.

Real-World Use Cases: Who Chooses What, and Why

A business owner with irregular income might use a 6-month individual note to create mid-year liquidity, while parking another portion in a fund to smooth returns through Q4. A physician with high W-2 income may prioritize note funds for tax simplicity, diversification, and monthly income without taking on underwriting work.

A seasoned LP in equity syndications could use note funds as a cash-flow bridge between equity deals or to reduce overall portfolio volatility.

Think of this less like a fork in the road and more like a pair of tools in the same toolbox. Use what the project calls for.

What Smart Investors Ask

“What if I choose wrong?”

Both structures can work well — but knowing your liquidity needs, timeline, and comfort with underwriting helps you make a smart decision.

“Will I lose access to my money?”

Individual notes are often locked for 12–24 months. Funds may offer more flexible redemption terms after the initial note matures but check the fine print.

“How do taxes compare?”

Neither structure offers depreciation, but both typically generate interest income. The key is to pair these with equity plays that provide tax shelter.

The Bottom Line: Use the Right Tool for the Job

This isn’t about picking a winner. Smart investors often use both strategies in different proportions depending on income needs, liquidity timeline, risk appetite, and time capacity.

One investor might use individual notes to target near-term cash flow goals, and a note fund for longer-term, passive diversification.

What matters most? Having a plan, not sitting on the sidelines waiting for perfect conditions.

Ready to explore how promissory notes could fit into your portfolio?

Scan the QR code below to book a free call with me. We’ll talk through your capital goals together and figure out which note structure is the best fit for you.