Disclaimer: The information in this article is provided to help you understand potential tax provisions under current law. These provisions are based on forward looking projections and may change with future legislation or IRS guidance. Your individual tax situation will vary, so please consult your own qualified tax and legal advisors before making any investment or planning decisions.

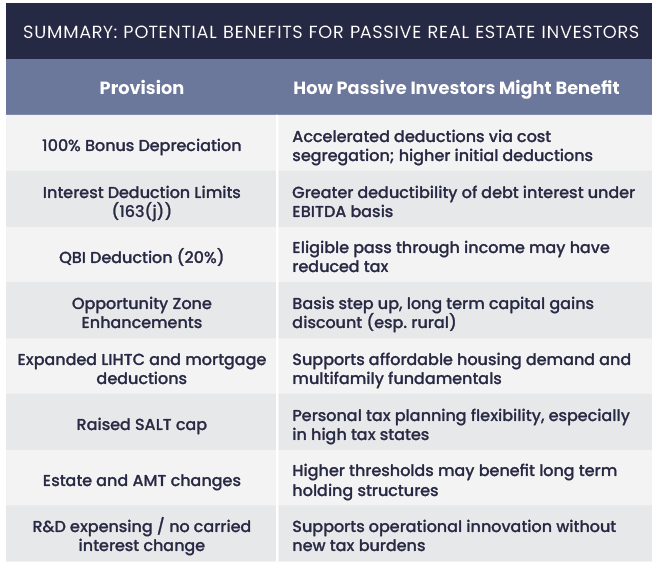

On July 4, 2025, President Trump signed into law the One Big Beautiful Bill Act (also known as BBB or OBBBA). This sweeping legislation both permanently extends many provisions of the 2017 Tax Cuts and Jobs Act and adds new, real estate friendly incentives. Passive investors in institutional quality real estate assets including apartments, self storage, hotels, express car washes, and real estate debt should consider how the bill may benefit their investments going forward.

Permanent Extension of 100% Bonus Depreciation

The BBB makes permanent the 100% bonus depreciation under section 168(k) for “qualified property” placed in service after January 19, 2025. This allows taxpayers to deduct the full cost of short-lived property, typically machinery, equipment, and building components depreciable over 20 years or less, in the year placed in service.

Favorable Interest Deduction Rules under Section 163(j)

BBB restores and permanently enacts the more taxpayer favorable EBITDA based interest limitation (rather than the stricter EBIT basis), effective for taxable years beginning after December 31, 2024. The “real property trade or business” election remains available, albeit with longer depreciation through the Alternative Depreciation System (ADS), which requires using longer recovery periods and straight-line depreciation instead of accelerated methods. BBB also requires most capitalized interest to be included in the 163(j) limitation, first against capitalized interest, then current interest deductions (goodwinlaw.com, washingtonpost.com).

Qualified Business Income (QBI) Deduction Enhanced and Made Permanent

The 20% QBI deduction under section 199A, allowing pass through entities to deduct 20% of qualified business income from real estate trades, REIT dividends, and publicly traded partnership income, has now been made permanent, with adjustments that may raise income thresholds and limitations in real estate sectors.

Opportunity Zone Enhancements

BBB makes the Opportunity Zone provisions permanent and imposes stricter eligibility criteria, including a narrower median income threshold (below 70% of area median). The legislation preserves capital gains tax deferral and offers a 10% basis step up after five years. Beginning in 2027, investments in rural Opportunity Zones held for at least five years qualify for an enhanced 30% capital gains tax discount, triple the benefit for non-rural OZs.

Expanded Low Income Housing Tax Credits and Mortgage Related Benefits

BBB expands the Low Income Housing Tax Credit (LIHTC), projected to support or preserve over one million affordable rental units between 2026 and 2035, likely boosting allocations and pricing for LIHTC equity funds.

At the same time, homeowner related incentives such as the mortgage insurance deduction are reinstated, and the existing cap on mortgage interest deduction ($750,000 loan limit for married filers) is made permanent. These elements may indirectly support demand in rental markets. While these are not direct passive investor benefits, they can improve market fundamentals for multifamily and affordable housing sectors.

SALT Deduction Cap Raised

Although passive real estate investors typically hold passive losses and rental property net income rather than itemize state and local taxes, the increase in SALT deduction cap from previously $10,000 to $40,000 for households earning under $500,000 (adjusting 1% annually through 2029) can reduce personal tax liability and indirectly benefit investment yield when investors live in high tax states.

High net worth investors in states like New York, California, or New Jersey may derive added flexibility in overall tax planning, potentially freeing capital for investment.

Estate, Gift Tax, and AMT Relief

Beginning in 2026, BBB permanently increases the estate and gift tax exemption to $15 million per individual (indexed for inflation) and raises the Alternative Minimum Tax exemption thresholds (to $500,000 for singles and $1 million for joint filers) with inflation indexing.

Additional Provisions with Secondary Impact

Research and Development (R&D) and Section 174 expensing: BBB makes full R&D expensing permanent, which may benefit real estate operating businesses involved in property tech, AI, energy systems in buildings, and data centers.

No carry interest tax changes: There is no new tax on carried interest across real estate funds; current treatment remains intact.

Outlook and Considerations

- The OBBBA significantly lowers tax burdens on real estate investment, especially for investors using cost segregation, leverage, and pass through structures.

- However, all forward looking language is contingent on IRS guidance and future administrative detail. Investors should expect potential clarifications and regulatory implementation over the next year.

- OZ investors should monitor IRS timelines for rural designations and reporting rules.

- The law is projected to increase federal deficits by approximately $3.3 to $4.5 trillion over ten years, which may bring future legislative adjustments or sunset clauses on certain provisions.

Outlook and Considerations

Evaluate cost seg studies: Confirm whether depreciation schedules align with maximum benefit under 100% expensing.

Review debt structures: Confirm qualification under the real property trade election to preserve more favorable interest deduction rules.

Review fund and entity structures: Ensure pass through income qualifies for section 199A QBI deductions.

Consider Opportunity Zone allocations: Especially those with rural focus, assess timing to meet five year holding thresholds.

Revisit estate or trust planning: Coordinate with tax counsel to maximize higher estate, gift, and AMT thresholds.

Review personal tax planning: You may now claim higher SALT deductions; coordinate with advisors for strategies involving trusts if applicable.

Conclusion

Trump’s “One Big Beautiful Bill” offers permanent enhancements to foundational real estate tax provisions, bonus depreciation, favorable interest limits, QBI deduction, and introduces significant new benefits for Opportunity Zone investors and affluent taxpayers via SALT and estate changes. Passive real estate investors in institutional quality assets may materially benefit from improved upfront cash flow, more predictable depreciation, and potential long term tax savings.

All projections are forward looking; actual outcomes will depend on IRS guidance and taxpayer specific circumstances. PassiveInvesting.com recommends coordination with tax and legal professionals to ensure optimal structuring and documentation under the new law.

We will continue providing updates in future newsletters as implementing guidance emerges and as market responses unfold.