If you have ever invested in one of our projects or another private equity real estate offering, then you have likely encountered the term “unreturned capital contribution.” This is another term that is sometimes understood but many investors do not have a full grasp as to why this term is so important for your overall returns.

What is the unreturned capital contribution?

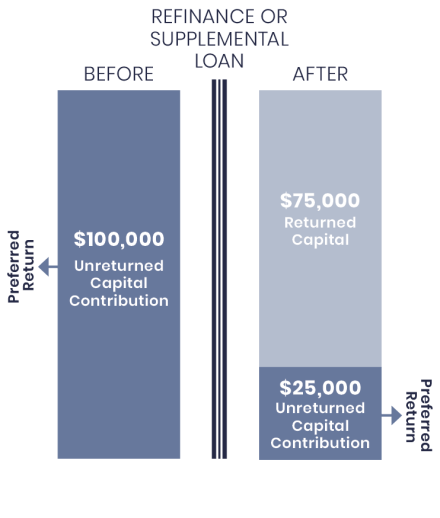

The unreturned capital contribution is the amount of capital that remains from your initial capital. For example (see figure 1), if you invested $100,000 into an offering your initial unreturned capital contribution would be $100,000. If the asset were to be refinanced or a supplemental loan taken out to return capital to investors, then your unreturned capital contribution would be reduced. Let’s say you received $25,000 back then your new unreturned capital contribution would be $75,000.

Even though your unreturned capital contribution has been lowered this does not necessarily mean that your equity percentage has been lowered. At PassiveInvesting.com we do not lower your equity in the deal when capital is returned but this is not always the case with other private equity real estate offerings so make sure you read your PPMs carefully prior to investing so you can be clear on how they handle capital events.

How are preferred returns impacted by the unreturned capital contribution?

The preferred return is directly impacted by the unreturned capital contribution. The calculation for determining the preferred return is solely based on the unreturned capital contribution. For example, if you invested $100,000 into an offering with a seven percent (7%) preferred return then your annual preferred return would be $7,000 ($100,000 x 7% = $7,000.) If we use the example above where after a capital event you received $25,000 which reduced your unreturned capital contribution to $75,000, then your new annual preferred return would only be $5,250 ($75,000 x 7% = $5,250.)

You may be thinking to yourself right now that this all makes sense and why should you care since this is how you originally understood the whole calculation. You would be correct if that is all you understood. However, not all offerings are created equal. In our offerings this all works just like my examples above. In other private equity real estate offerings, the monthly or quarterly distributions will also reduce your unreturned capital contribution. This can have varying tax issues and reduces your overall preferred return. It is great for the operator since the preferred return each month or quarter is being reduced so they will be able to participate in the cash flows earlier. In other words, the operator is treating your monthly distributions as a return of capital and not a true return on investment.

Let’s look at an example to further explain how the scenario above will affect your on-going preferred returns. If you invested $100,000 then your initial unreturned capital contribution would be $100,000. Assuming there is enough cash flows to distribute the full preferred return, when you receive your first monthly distribution of $583.33 ($100,000 x 7% = $7,000 / 12 = $583.33) this would reduce your unreturned capital contribution to $99,416.67 ($100,000 – $583.33 = $99,416.67.) The next month your distribution would be slightly lower at only $579.93 ($99,416.67 x 7% = $6,959.17 / 12 = $579.93.)

As you can see in figure 2, the unreturned capital contribution each month is being lowered so that in subsequent months your overall distribution amount is going down. This also allows the operator to receive more of the cash flows since they do not have as much preferred return to distribute since the unreturned capital contribution is being diluted over time.

This is not good for you as the investor but great for the operator.

Potential tax issues when distributions are return of capital vs return on investment

*DISCLAIMER: I am not a tax advisor, nor do I play one on TV. Make sure you seek tax advice from a licensed professional. This is for educational purposes only and is my opinion based on my limited interpretation.

The tax implications should also be considered here too. When you are receiving a distribution as return of capital then you would not be paying any taxes on those distributions. This may sound great but as you saw earlier your overall returns are getting diluted too.

If you are receiving your distributions as return on investment, then your taxes are deferred since the depreciation loss will help to offset any of the gains from cash flows. In this scenario, you would continue to maintain a higher level of return since your unreturned capital contribution is not being diluted over time.

The takeaway here is to make sure that you are investing in offerings that are not diluting your unreturned capital contributions over time due to distributions. At PassiveInvesting.com we do not dilute your unreturned capital contributions from your monthly distributions and always take care of our passive investors. Our goal is to have you invest with us for many decades in multiple offerings, so we set up our offerings to have our investors’ best interest in mind.