What is an Interest Rate Cap?

When acquiring an asset with a loan that has a floating rate, it is a smart idea to purchase what is called an “interest rate cap” to mitigate your downside risk.

The interest rate cap is basically an insurance policy that prevents your interest rate from going higher than a certain point.

The interest rate cap is something that many lenders will often require the borrower to buy when closing on the loan to avoid issues where debt rises to a point where the borrower can no longer afford to pay the debt service.

For example, if you get a floating rate loan that is SOFR + 350bps then you would be paying 8.80% based on the current 1-month SOFR rate. However, if the loan originated at the beginning of 2022, then the rate would have been closer to 3.50%. The most common interest rate cap is a 2 year at 200bps above the floor rate which is the lowest rate you would be paying on the loan. In this scenario, let’s assume the floor is 3.50%. This would mean that your maximum interest rate would be 5.50% (3.50% + 2.00% = 5.50%).

10,500% Increase in the SOFR Rate in 18 Months

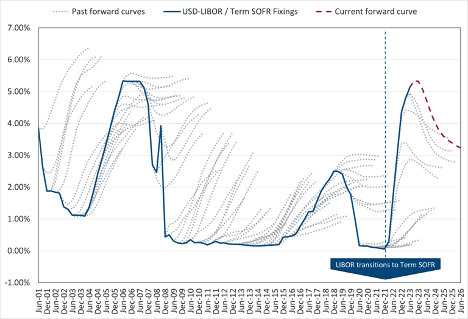

In January of 2022, the SOFR rate was 0.05% and, as you can see from figure 1.1, the SOFR rate has had an extremely fast run up to a point where the rate now is hovering at 5.30%. That is a 10,500% increase in the SOFR rate in only 18 months, which is unprecedented.

So, you can see how important these interest rate caps can be, especially in an environment that we are in now where the Fed has increased rates so high that everyone is hitting these interest rate caps.

All of our multifamily assets have these interest rate caps, and they are currently paying out over $1.5mil each month across our portfolio in interest payments on our behalf.

Figure 1.1 – Secured Overnight Financing Rate Chart

The Problem: Rate Cap Expirations

The problem with these interest rate caps, is that many of them are about to expire and this means the extra burden will be on the property to pay this extra debt service. These are about to expire because we are coming upon the 2-year mark for these crazy high interest rate hikes and many operators are finding themselves making a decision to do one of three things:

- Refinance

- Sell

- Extend the rate cap

Let’s dive into each of these options really quick:

1 – Refinance: this one seems like an obvious choice; however, in this interest rate environment in order to refinance an asset, you would need to come to the table with a ton of extra cash to get the LTV low enough to support the DSCR (see sidebar). This is because if the DSCR is too low (<1.25x), due to the excess debt payments, then the LTV must be lowered to get the debt service low enough to support the DSCR test for the loan which is usually 1.25x. This is one of the major issues with predicting refinances in return metrics which is something that I talk about in my Red Flags for Passive Investing article that my wife and I put together after vetting other deals and operators for our own LP portfolio. We like refinancing, but many times it just won’t make sense.

2 – Sell: this would be nice as well if the valuations had not been impacted by the drastic increase in interest rates. The cap rates have increased significantly over the last 18 months as the debt service has increased. Now this valuation problem is only a problem if you are being forced to sell the asset in this type of environment. Most operators will choose one of the other options so the asset can be held onto for longer to sell in a more optimal market condition.

3 – Extend the rate cap: most operators will choose this option as it has the least amount of friction and is the easiest if there is enough cash on the property to support the cost of the rate cap extension. The one issue here is that the cost of purchasing these extensions has skyrocketed as you can imagine. Where you could buy these rate caps for a couple hundred thousand when acquiring an asset 2 years ago, now these same interest rate caps can cost millions of dollars depending on the loan size and how long the extension is good for. The operator will likely need to get an additional loan to pay for these rate cap extensions or potentially do a capital call from investors.

Lender Foreclosure – The Real Truth!

If none of these options are executed, then the lender could potentially foreclose on the asset which could cause the investors to lose a large portion, if not all, of their capital invested in the property. Now, this is a worse case scenario but could certainly happen if the operator is not making decisions properly with the asset. This is why it is uber important to perform proper due diligence on operators to make sure they have the experience necessary to make these types of decisions on your behalf as a passive investor. This is also why it is important to make sure the operator has skin in the game, other than their reputation, to lose when making these hard decisions.

At PassiveInvesting.com, our primary goal is capital preservation and that is what we always try to do when you, as one of our trusted investors, entrust us with your hard-earned money in one of our assets.

SOFR – Historically and Forward Looking: Where are rates headed?

You can see in figure 1.2 the historical LIBOR/SOFR forward curve chart which shows prior predictions and how they ended up fairing. What is interesting to note is that most predictions are showing the rates are going higher followed by a swift drop in the rate following the various times where interest rates rose.

Figure 1.2: 1-month USD LIBOR vs. historical forward curves (Revised as of June 30, 2023)

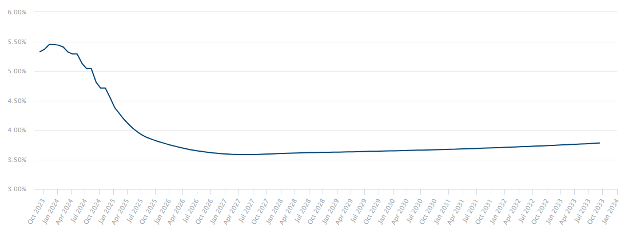

In figure 1.3 you can see the prediction on the SOFR 1-month forward curve. The predictions are showing that the interest rates should begin dropping by EOY 2023 and into Q1 2024. These are only predictions of course and only time will truly tell where rates will go. We can only try to determine based on the historical “hairy” chart and the future prediction chart where the rates may end up.

Figure 1.3: 1-month Term SOFR Forward Curve (Updated as of September 6, 2023)

The Ideal Solution: Lowering Interest Rates

One of the best things to help reduce the interest rates is for the economy to go into a deep recession. This would cause the Fed to overreact as they normally do and drop the Fed rate quickly in an attempt to bring things back to somewhat of a homeostasis. I know this is not an ideal thing to “wish” for as many people are hurt in a recession. However, it is definitely the most ideal solution for the debt service crunch that we seem to find ourselves in these days.

The Practical Solution: The Prudent Option for Rate Caps

Purchasing the rate cap extension is likely the best option for most operators as this would allow them to continue to operate their assets as normal, at least for the next 12 months until the rate cap expires again. Most predictions are that interest rates will be in a much better position in the next 12 months where the option for a sale or potential refinance would be back on the table again if the operator chooses to keep the asset.

You will start to see over the next 4-6 months many operators scrambling to find the cash to pay for these rate cap extensions. This will most likely be the scenario for those operators that are not paying attention to things or not acting fast enough. It is best to start planning now to properly execute the rate cap extensions on time instead of trying to wait until the last minute.